Offshore Trustee Solutions for International Wealth Monitoring

Wiki Article

Sailing Into Success: Opening the Prospective of Offshore Count On Services for International Riches Conservation

The Advantages of Offshore Trust Fund Services for Wealth Conservation

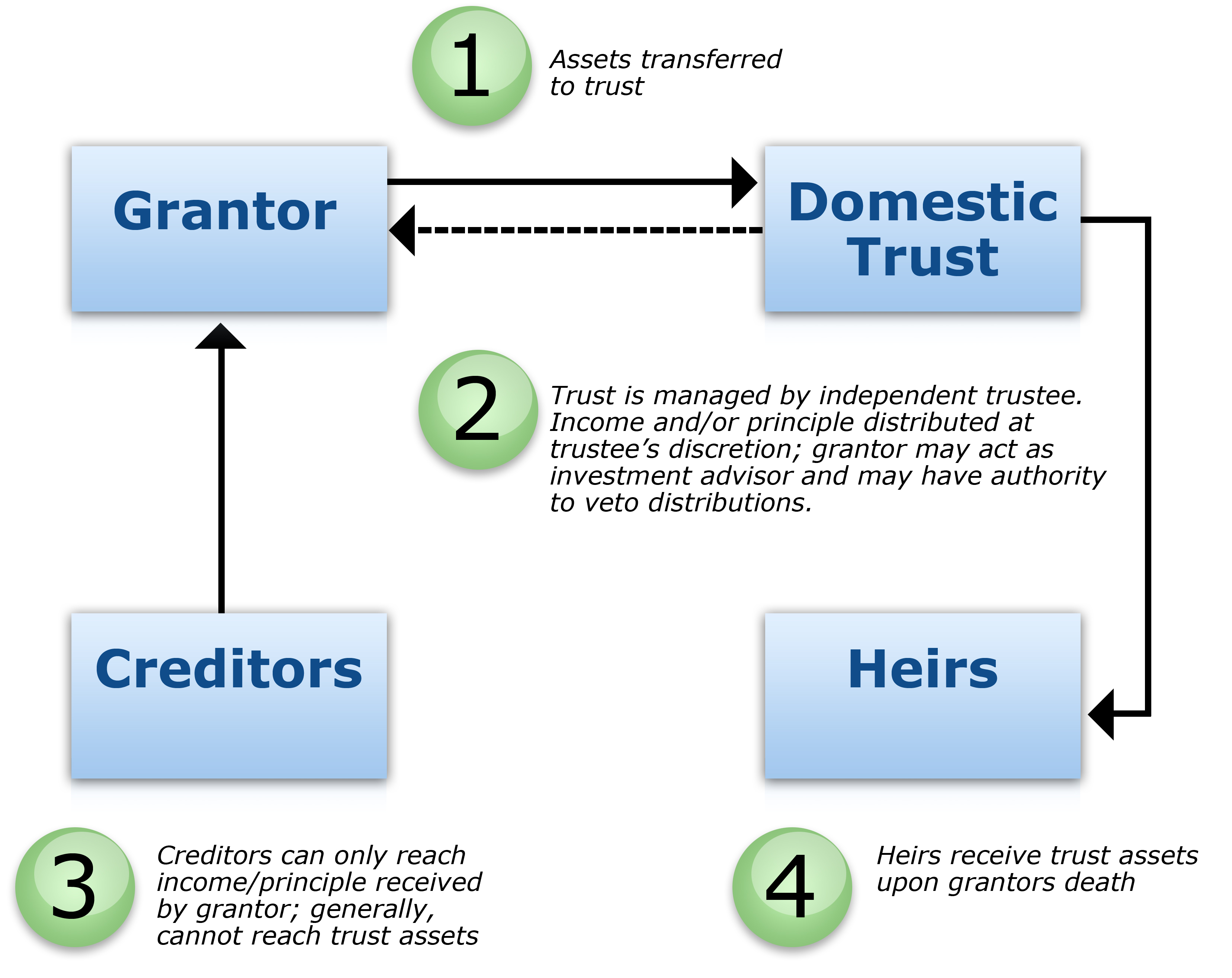

You'll be impressed at the advantages of offshore depend on solutions for riches preservation. Offshore count on services offer a variety of advantages that can help you protect your assets and ensure their long-term development. Among the vital advantages is the capacity to safeguard your wide range from possible creditors and lawful claims. By positioning your properties in an offshore count on, you produce a lawful obstacle that makes it tough for others to access your wide range. If you live in a nation with an unstable political or financial climate., this is especially beneficial.One more advantage of overseas count on solutions is the potential for tax obligation optimization. Numerous overseas territories use desirable tax legislations and incentives that can assist you lessen your tax obligation obligation. By making use of these services, you can legally lower your tax concern and optimize your wealth buildup.

In addition, offshore depend on solutions provide a higher degree of personal privacy and confidentiality. Unlike in onshore territories, where economic information might be quickly accessible, overseas trust funds provide a higher level of anonymity. This can be particularly appealing if you value your personal privacy and intend to maintain your economic events discreet.

In enhancement, overseas trust solutions provide flexibility and control over your possessions. You can select the terms and problems of the trust fund, define exactly how it needs to be taken care of, and also determine when and how your beneficiaries can access the funds. This level of control enables you to tailor the depend on to your specific demands and objectives.

Understanding the Legal Framework of Offshore Trust Funds

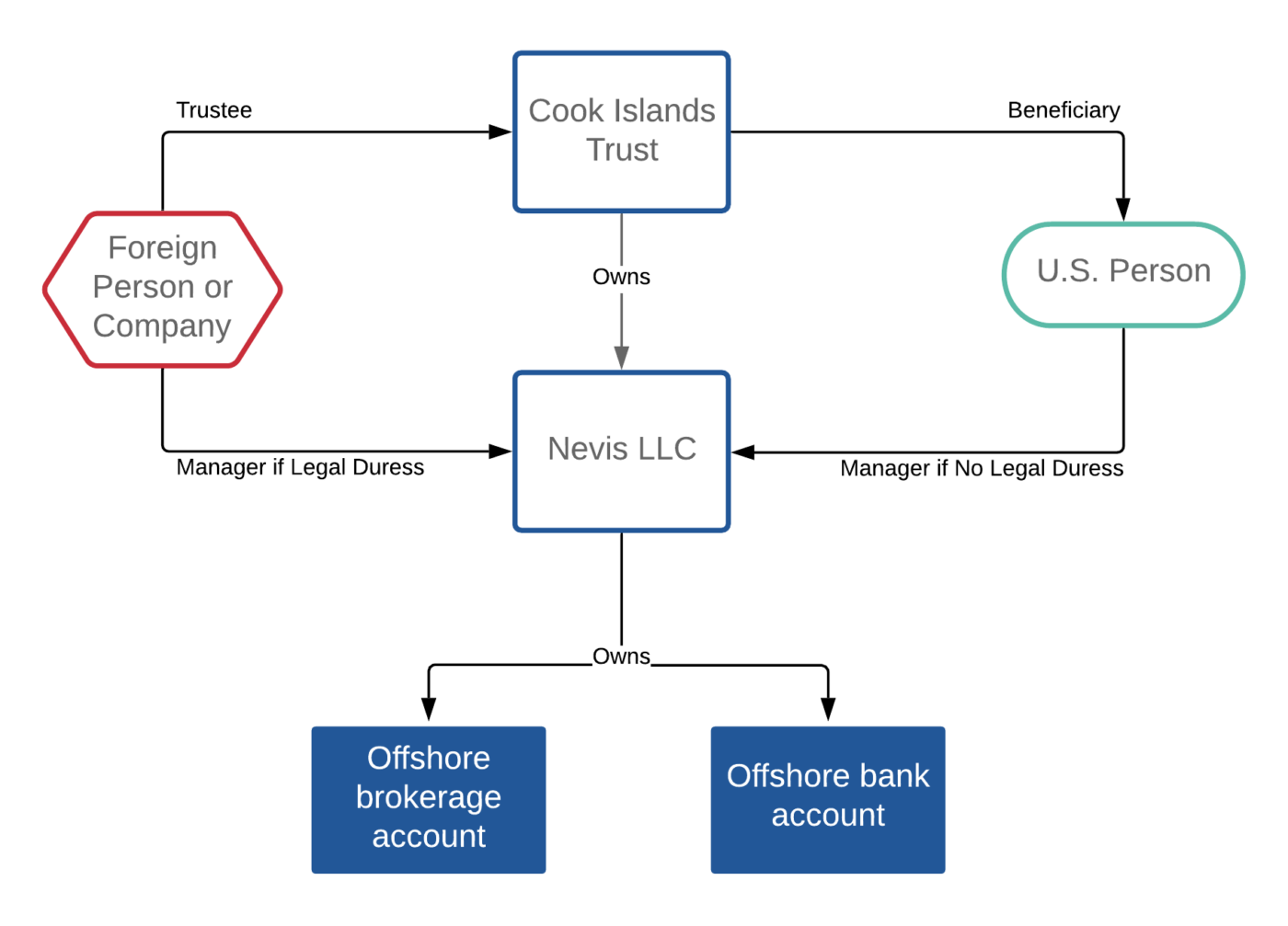

Recognizing the lawful structure of offshore trusts can be complicated, yet it's necessary for individuals seeking to protect their wide range - offshore trustee. When it concerns overseas counts on, it is necessary to know that they are governed by certain legislations and policies, which vary from jurisdiction to jurisdiction. These lawful structures figure out just how the trusts are established, took care of, and exhaustedOne secret aspect to think about is the choice of the jurisdiction for your overseas trust fund. Each territory has its own set of policies and laws, and some may offer much more desirable conditions for wide range preservation. You'll require to analyze elements such as the security of the legal system, the degree of privacy provided, and the tax obligation implications prior to making a choice.

Once you've picked a territory, it's critical to recognize the lawful needs for establishing up and maintaining an offshore trust. This consists of adhering to reporting responsibilities, ensuring appropriate documentation, and sticking to any kind of constraints or limitations imposed by the territory. Failure to satisfy these requirements can cause legal and monetary repercussions.

Key Considerations for Picking an Offshore Trust Territory

When selecting an overseas trust fund territory, it is necessary to very carefully take into consideration variables such as the territory's legal stability, level of confidentiality, and tax ramifications. These crucial factors to consider will certainly guarantee that you make an enlightened decision that lines up with your wealth conservation goals. Legal security is essential as it provides a strong foundation for the trust fund's procedure and protection of your assets. You want a territory that has a reputable lawful system and a background of respecting building legal rights. Discretion plays an important duty in offshore count on preparation. You require a territory that promotes and values customer privacy, providing robust procedures to guard your individual and monetary info. This will guarantee that your wealth continues to be secured and your events continue to be personal. Last but not least, tax ramifications can not be forgotten. Various territories have differing tax obligation programs, and you must analyze the impact on your depend on's possessions and revenue. Deciding for a jurisdiction with beneficial tax legislations can assist take full advantage of the advantages of your overseas trust. By thoroughly thinking about these variables, you can pick an offshore count on territory that matches your needs and supplies the essential level of security for your wide range.Making Best Use Of Possession Protection Via Offshore Depend On Structures

Maximizing property protection can be attained via offshore trust fund frameworks that provide a safe and secure and private atmosphere for maintaining your riches. By making use of offshore trust funds, you can secure your properties against potential lawful claims and guarantee their long-lasting preservation.Offshore count on frameworks offer a series of benefits that can assist protect your possessions. One vital advantage is the capacity to establish rely on jurisdictions with solid legal frameworks and durable asset security laws. These jurisdictions you can try these out are frequently renowned for their commitment to discretion, making it difficult for lenders or litigants to access info concerning your trust or its possessions.

Moreover, overseas trusts offer a layer of privacy. By positioning your assets in a count on, you can preserve a specific degree of personal privacy, shielding them from unwanted attention or scrutiny. This can be specifically advantageous for high-net-worth individuals or those in sensitive professions.

In enhancement to possession protection, offshore trust fund frameworks provide tax obligation benefits. Some jurisdictions enforce little to no tax on income generated within the trust fund, enabling your wealth to intensify and grow over time. This can cause substantial tax obligation cost savings and boosted wide range conservation.

Overall, offshore trust fund structures supply a safe and private setting for protecting your wealth. By making best use of property security through these frameworks, you can ensure the long-term preservation and growth of your possessions, while appreciating the benefits of privacy and tax benefits.

Exploring Tax Benefits and Compliance Demands of Offshore Trusts

Discovering the tax obligation advantages and compliance needs of overseas trust funds can give useful insights into the legal responsibilities and economic benefits connected with these frameworks. Offshore trusts are usually located in territories that supply beneficial tax obligation regimes, such as low or no taxes on trust earnings and funding gains. By positioning your assets in an offshore depend on, you can legitimately minimize your tax obligation liability and maximize your riches conservation.Verdict

So there you have it - the potential of offshore count on solutions for global wide range preservation is immense. By understanding the benefits, legal framework, and crucial factors to consider, you can make informed decisions to make the most of possession security. In addition, discovering the tax benefits and conformity needs of overseas trusts can additionally boost your wealth preservation techniques. Do not miss out on out on the possibilities that offshore count on services can provide - cruise right into success today!When deciding on an overseas trust fund territory, it's essential to carefully consider variables such as the territory's lawful stability, level of discretion, and tax ramifications. By very carefully taking into consideration these elements, you can choose an overseas count on territory that fits your needs and gives the needed level of defense for your riches.

Offshore counts on are frequently located in jurisdictions that supply desirable tax regimes, such as reduced or zero tax on trust revenue and capital gains - offshore trustee. By positioning your possessions in an overseas count on, you can legitimately decrease your tax responsibility and about his maximize your riches preservation. In addition, checking out the tax obligation advantages and conformity requirements of offshore trust funds can additionally improve your wealth conservation methods

Report this wiki page